Your current location is:Fxscam News > Exchange Brokers

The government is considering adjusting tariffs on the United States in July.

Fxscam News2025-07-23 05:57:17【Exchange Brokers】6People have watched

IntroductionForeign exchange software Baidu mobile assistant,Foreign exchange app trading platform,Canada Considers Adjusting Steel and Aluminum Counter-Tariffs in Response to Trump Trade PressureOn

Canada Considers Adjusting Steel and Foreign exchange software Baidu mobile assistantAluminum Counter-Tariffs in Response to Trump Trade Pressure

On June 20th, the Canadian government announced that if substantial progress is not made in trade negotiations with the U.S. government, it will adjust counter-tariffs on U.S. steel and aluminum products next month. The Canadian side emphasized that this move is aimed at responding to the high tariffs imposed by the Trump administration and protecting against unfair impacts on Canada's domestic industries.

According to an official Canadian statement: "We will adjust the existing counter-tariffs on July 21st to coincide with the progress of broader trade arrangements with the U.S." Currently, the U.S. imposes tariffs of up to 50% on imported steel and aluminum, while Canada responds with a 25% retaliatory tariff.

Prime Minister Carney stated at a press conference that if the negotiation results are unsatisfactory, countermeasures will be escalated. "We will negotiate in good faith, but we must also protect the interests of Canadian workers and businesses," he added.

Using Domestic Steel and Aluminum to Support Local Manufacturing

In addition to tariff adjustments, Canada announced that new regulations will be applied to federal government projects: only steel and aluminum produced in Canada or from "reliable partners" with trade agreements with Canada can be used. This policy aims to promote domestic manufacturing development and guard against potential dumping risks.

Benefiting from the policy announcement, shares of Canadian steel manufacturer Algoma Steel Group Inc. rose 7.9%, reaching their highest intraday level since early March.

The Canadian Steel Producers Association and the Steelworkers Union issued a joint statement expressing their willingness to actively cooperate with government policies, stating they will "maintain constructive dialogue with the federal government to jointly formulate industry protection plans that align with national interests."

Refusing to Passively Accept Unfair Tariffs

Carney also pointed out that Canada will not passively accept certain tariffs imposed by the U.S. during trade negotiations. "True free trade should be mutually beneficial," he said. "If the agreement benefits Canada, we will accept it; if not, we will firmly reject it."

Canadian government officials are in ongoing communications with senior U.S. officials. Prime Minister Carney revealed that he maintains "relatively frequent" contact with President Trump. Meanwhile, Cabinet Minister LeBlanc is also in talks with U.S. Commerce Secretary Howard Lutnick and Trade Representative Jamison Greer, with a new round of discussions scheduled for Friday.

Preventing Dumping and Expanding Funding Support for Domestic Enterprises

Given the possibility that high U.S. steel and aluminum tariffs could lead global manufacturers to redirect shipments to Canada, the Canadian side is concerned about potential market dumping risks. Therefore, Canada plans to establish new import quotas for steel and aluminum, and implement related tariff control measures in the coming weeks.

Simultaneously, Carney announced the government will provide a total of 10 billion Canadian dollars in federal loans to offer liquidity support to large domestic enterprises facing financing difficulties. "We must ensure that key industries do not lose competitiveness due to international pressure," he said.

Risk Warning and DisclaimerThe market carries risks, and investment should be cautious. This article does not constitute personal investment advice and has not taken into account individual users' specific investment goals, financial situations, or needs. Users should consider whether any opinions, viewpoints, or conclusions in this article are suitable for their particular circumstances. Investing based on this is at one's own responsibility.

Very good!(8)

Related articles

- Driss IFC is a Scam: Beware!

- The central bank issued 60 billion yuan in offshore bonds, signaling exchange rate stabilization.

- Before the ECB decision, the euro faces pressure, while the pound focuses on GDP data.

- Challenges and Responses to ECB's Shift: From Interest Rate Corridor to Floor System

- Kudotrade Review: Non

- The US dollar peaks as yuan falls below 7.35, spotlighting central bank efforts.

- Japan's salary growth peaks in 32 years, boosting rate hike hopes and yen strength.

- The strong U.S. dollar pressures non

- Market Insights: Jan 22nd, 2024

- The dollar pared gains after Trump's tariffs, with the yen leading G

Popular Articles

- Binance Plans to Reduce Stake in Gopax to Solve Debt Issues

- The Renminbi declined in November but has rebounded, driven mainly by the strong US dollar.

- Australia's unemployment dropped to 3.9% in November, highlighting labor market resilience.

- Japan's Q3 growth revised up to 1.2%, fueling focus on central bank rate hike timing.

Webmaster recommended

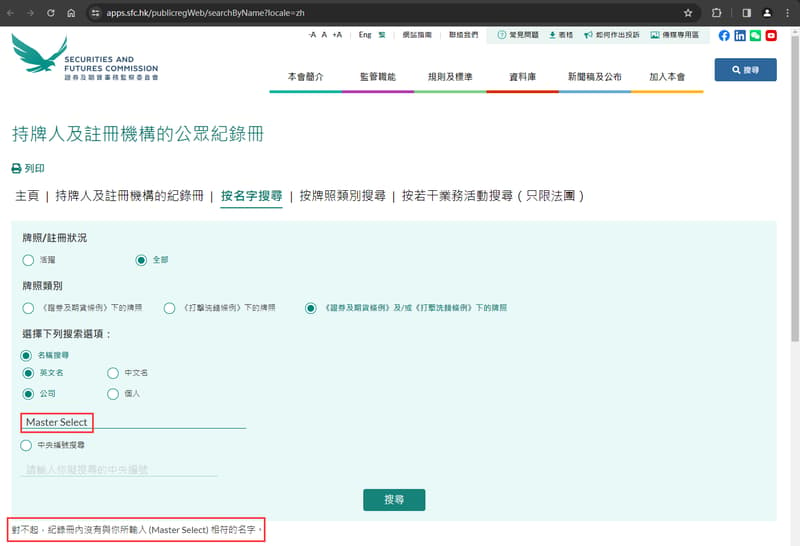

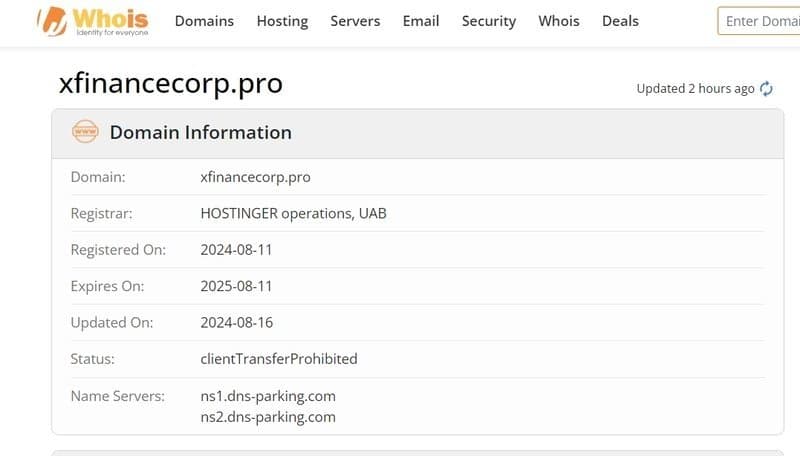

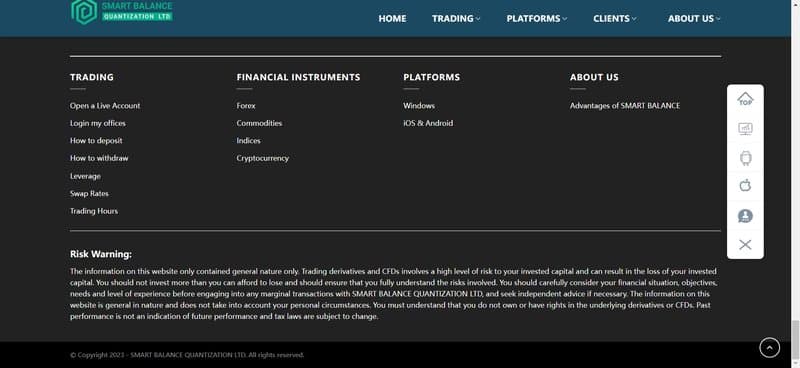

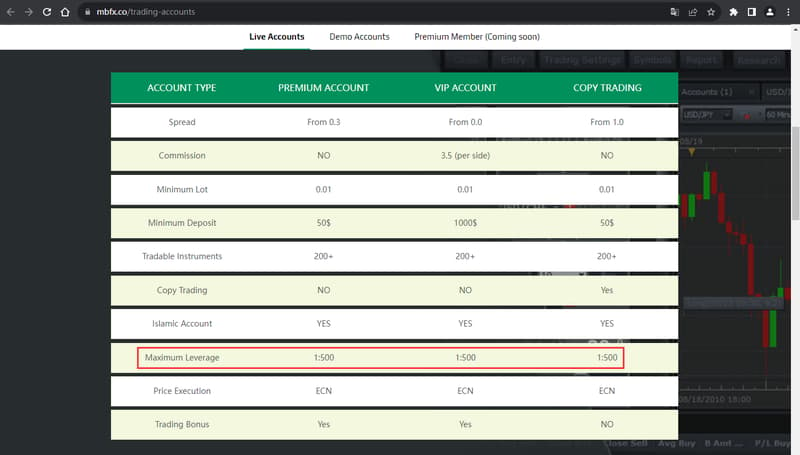

Investor Warnings About Master Select Group: Scams and Risks Explained

The US dollar steadied as markets assessed Trump's tariff policy and major currencies diverged.

Gold prices rise slightly, fueled by U.S. CPI and rate cut expectations, amid geopolitical tensions.

The Japanese yen appreciates approaching the 152 mark, while the US dollar weakens.

Analysts believe Softbank may turn losses into profits in the first quarter.

The US dollar retreated, the pound weakened, and non

2025 Outlook: Renminbi Resilience Amid a More Rational Forex Market

Yen nears 153 as BOJ may delay rate hikes to March, raising carry trade risks.